Your pitch deck is often the first impression investors have of your startup. In 2025's competitive funding landscape, where only 0.05% of startups receive venture capital, having a compelling, well-structured pitch deck is more critical than ever.

This comprehensive guide walks you through creating a winning pitch deck, slide by slide, with real-world examples, common mistakes to avoid, and a downloadable template to get you started.

Why Your Pitch Deck Matters in 2026

The Current Funding Reality

2025 Fundraising Landscape:

- Average time to raise: 4-6 months (up from 2-3 months in 2021)

- Investor meetings per round: 50-100 meetings to close a round

- Success rate: Only 1 in 2,000 startups receive VC funding

- First impression window: Investors decide in 3-4 minutes if they're interested

- Deck review time: Investors spend 3 minutes 44 seconds on average reviewing decks

What Investors Look For:

- Clear problem and solution - Can they understand it in 30 seconds?

- Large market opportunity - Is this a billion-dollar market?

- Strong team - Can this team execute on the vision?

- Traction and validation - Is there evidence of product-market fit?

- Compelling story - Does this inspire confidence and excitement?

Types of Pitch Decks

1. Teaser Deck (5-7 slides)

- Purpose: Initial outreach and email introductions

- Length: 5-7 slides maximum

- Focus: Problem, solution, traction, team, ask

- Goal: Secure a meeting

2. Presentation Deck (10-15 slides)

- Purpose: In-person or video call presentations

- Length: 10-15 slides

- Focus: Complete story with all key elements

- Goal: Generate investor interest and move to due diligence

3. Reading Deck (15-20 slides)

- Purpose: Sent after meetings for detailed review

- Length: 15-20 slides with appendix

- Focus: Comprehensive information with supporting data

- Goal: Answer questions and facilitate due diligence

4. Demo Day Deck (10 slides)

- Purpose: Accelerator demo days and pitch competitions

- Length: Exactly 10 slides (often required)

- Focus: High-level story optimized for 3-5 minute pitch

- Goal: Generate investor interest for follow-up meetings

The Essential Pitch Deck Structure

Overview: The 10 Core Slides

Every successful pitch deck includes these fundamental elements:

- Problem - What pain point are you solving?

- Solution - How does your product solve it?

- Market Size - How big is the opportunity?

- Product - What have you built?

- Traction - What validation do you have?

- Business Model - How do you make money?

- Competition - Who else is in this space?

- Team - Why are you the right people?

- Financials - What are your projections?

- Ask - How much are you raising and why?

Let's dive deep into each slide with examples, best practices, and common mistakes.

Slide 1: Problem

What to Include

Core Elements:

- Clear problem statement - One sentence that captures the pain

- Who has this problem - Specific target customer segment

- Current impact - Quantify the cost or pain of the problem

- Why now - What's changed to make this problem urgent?

- Personal connection - Why you care about solving this (optional but powerful)

Best Practices:

- Be specific - "Small businesses waste 15 hours/week on manual bookkeeping" beats "Accounting is hard"

- Use data - Quantify the problem with statistics and research

- Show empathy - Demonstrate you understand the customer's pain

- Keep it simple - One clear problem, not multiple issues

- Make it relatable - Use scenarios investors can understand

Before building your pitch deck, ensure you've properly validated the problem. Our product validation guide walks through customer discovery and problem validation techniques.

Real-World Example:

Airbnb's Problem Slide: "Price of hotels and lack of local connection when traveling"

- Simple, clear, and relatable

- Everyone has experienced expensive hotels

- Hints at emotional benefit (local connection)

Common Mistakes:

- ❌ Too vague - "Communication is broken" doesn't specify what or for whom

- ❌ Multiple problems - Confuses the narrative and dilutes focus

- ❌ No quantification - Missing data on problem size or impact

- ❌ Solution in disguise - Describing your product instead of the problem

- ❌ Unrelatable - Problem only makes sense to domain experts

Problem Slide Template

HEADLINE: [One sentence problem statement]

WHO: [Target customer segment]

IMPACT: [Quantified cost/pain]

- Statistic 1

- Statistic 2

- Statistic 3

WHY NOW: [Market timing or trend]

Slide 2: Solution

What to Include

Core Elements:

- Product overview - What you've built in one sentence

- How it works - Simple explanation of your approach

- Key benefits - 3-4 main value propositions

- Differentiation - What makes your solution unique

- Visual representation - Screenshot, diagram, or demo

Best Practices:

- Show, don't tell - Use product screenshots or mockups

- Focus on benefits - What customers get, not just features

- Keep it simple - Avoid technical jargon and complexity

- Connect to problem - Explicitly link back to the problem slide

- Demonstrate feasibility - Show this is achievable, not science fiction

Real-World Example:

Uber's Solution Slide: "Tap a button, get a ride"

- Incredibly simple value proposition

- Shows the product interface

- Emphasizes ease of use

- Clear differentiation from taxis

Common Mistakes:

- ❌ Feature dump - Listing every feature instead of core value

- ❌ Too technical - Using jargon that investors don't understand

- ❌ No visuals - Text-only slides are boring and unclear

- ❌ Unclear differentiation - Sounds like existing solutions

- ❌ Overpromising - Claims that seem unrealistic or unproven

Solution Slide Template

HEADLINE: [One sentence solution]

HOW IT WORKS:

[2-3 sentence explanation]

KEY BENEFITS:

✓ Benefit 1

✓ Benefit 2

✓ Benefit 3

[Product screenshot or diagram]

Slide 3: Market Size

What to Include

Core Elements:

- Total Addressable Market (TAM) - Total market demand

- Serviceable Addressable Market (SAM) - Market you can reach

- Serviceable Obtainable Market (SOM) - Market you can capture

- Market growth rate - How fast is the market expanding?

- Market trends - What's driving growth and opportunity?

Best Practices:

- Use credible sources - Cite Gartner, IDC, McKinsey, or industry reports

- Bottom-up calculation - Show your math: customers × price × frequency

- Be realistic - Conservative estimates are more credible

- Show growth - Demonstrate market is expanding, not shrinking

- Connect to your business - Explain how you'll capture market share

Market Size Calculation Methods:

Top-Down Approach:

TAM = Total industry size from research reports

SAM = TAM × % you can realistically serve

SOM = SAM × realistic market share (3-5% for startups)

Bottom-Up Approach:

TAM = Total potential customers × Average revenue per customer

SAM = Reachable customers × ARPC

SOM = Customers you can acquire in 3-5 years × ARPC

Real-World Example:

Uber's Market Size:

- TAM: $1.3 trillion global transportation market

- SAM: $140 billion taxi and car service market

- SOM: $10 billion in target cities over 5 years

Clear progression from total market to realistic target

Common Mistakes:

- ❌ Only showing TAM - Investors want to see realistic capture potential

- ❌ Unrealistic projections - Claiming 50% market share in year 3

- ❌ No sources - Made-up numbers without credible backing

- ❌ Shrinking market - Showing declining industry trends

- ❌ Confusing presentation - Complex charts that obscure the message

Market Size Slide Template

HEADLINE: $XXB Market Opportunity

TAM: $XXB

[Total market size with source]

SAM: $XXB

[Serviceable market with calculation]

SOM: $XXB

[Obtainable market over 3-5 years]

MARKET GROWTH: XX% CAGR

[Growth rate and key drivers]

Slide 4: Product

What to Include

Core Elements:

- Product demonstration - Screenshots, video, or live demo

- Key features - 3-5 most important capabilities

- User experience - How customers interact with product

- Technology highlights - Unique technical advantages (if relevant)

- Product roadmap - Future development plans (brief)

Best Practices:

- Show the actual product - Real screenshots, not mockups

- Focus on user value - Benefits over technical specifications

- Keep it visual - Images and diagrams over text

- Demonstrate differentiation - What makes your product unique

- Show it works - Evidence of functionality and reliability

Real-World Example:

Dropbox's Product Slide:

- Simple screenshot showing folder sync

- Clear visual of files across devices

- Emphasized simplicity and ease of use

- Showed actual working product, not concept

Common Mistakes:

- ❌ No visuals - Text descriptions instead of product images

- ❌ Too many features - Overwhelming list of capabilities

- ❌ Mockups only - No evidence of working product

- ❌ Technical jargon - Focus on architecture instead of user value

- ❌ Vaporware - Showing features that don't exist yet

Product Slide Template

HEADLINE: [Product name and tagline]

[Large product screenshot or demo]

KEY FEATURES:

• Feature 1 - [User benefit]

• Feature 2 - [User benefit]

• Feature 3 - [User benefit]

WHAT'S NEXT:

[1-2 sentence roadmap]

Slide 5: Traction

What to Include

Core Elements:

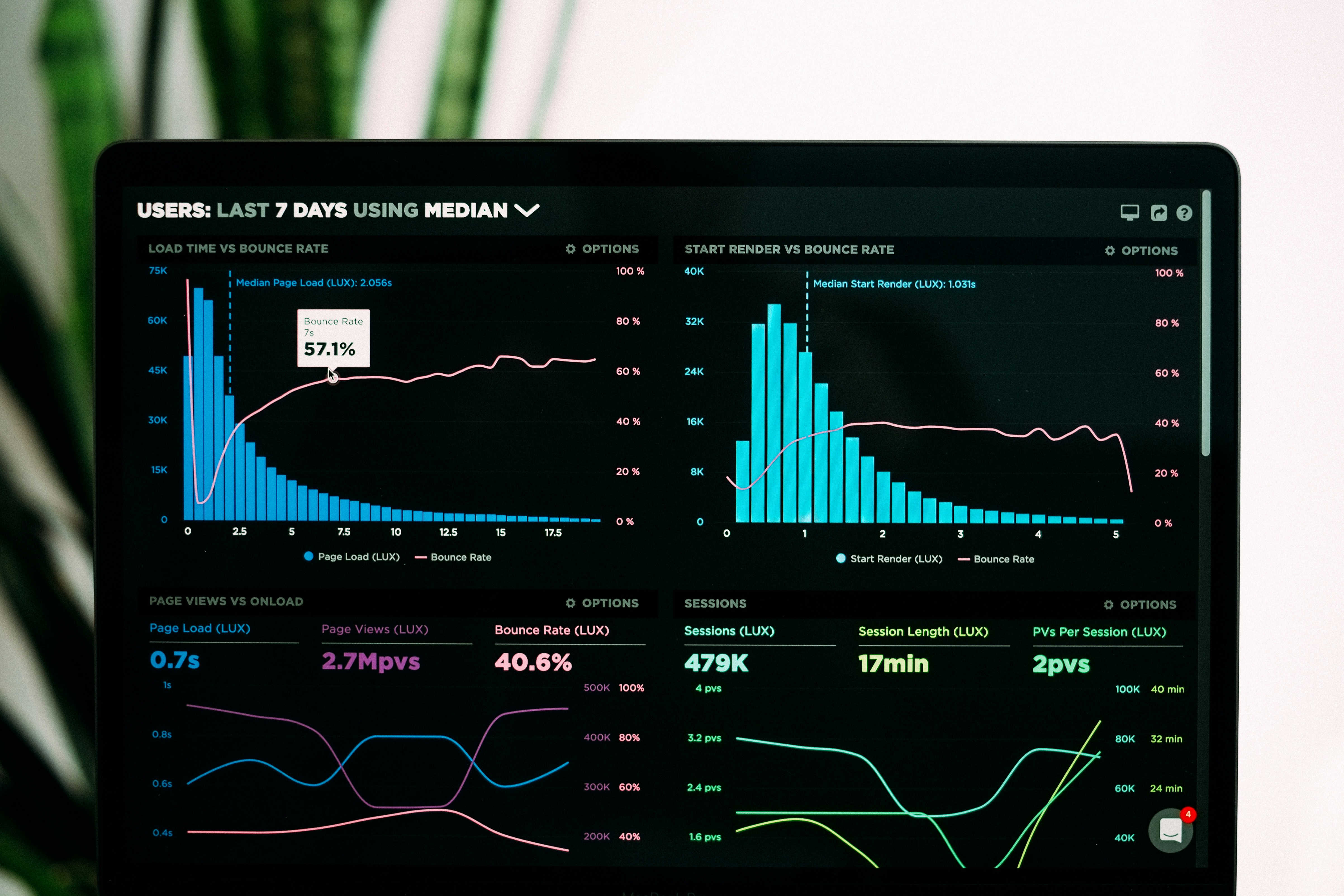

- Key metrics - Revenue, users, growth rates

- Growth trajectory - Charts showing upward trends

- Customer validation - Testimonials or case studies

- Partnerships - Strategic relationships and distribution

- Milestones achieved - Product launches, team hires, revenue goals

Best Practices:

- Show growth - Upward trending charts are powerful

- Be specific - Exact numbers, not ranges or estimates

- Choose relevant metrics - Match your business model and stage

- Provide context - Explain what the numbers mean

- Include social proof - Customer quotes or logos

For more on tracking the right metrics for your startup, see our complete guide to startup metrics and KPIs.

Key Metrics by Business Model:

SaaS:

- Monthly Recurring Revenue (MRR)

- Annual Recurring Revenue (ARR)

- Customer count and growth rate

- Churn rate

- Customer Acquisition Cost (CAC)

- Lifetime Value (LTV)

Marketplace:

- Gross Merchandise Value (GMV)

- Take rate

- Number of buyers and sellers

- Transaction volume

- Repeat purchase rate

Consumer App:

- Monthly Active Users (MAU)

- Daily Active Users (DAU)

- Engagement metrics (time spent, sessions)

- Viral coefficient

- Retention rates

E-commerce:

- Revenue and growth rate

- Order volume

- Average order value

- Customer acquisition cost

- Repeat purchase rate

Real-World Example:

Airbnb's Traction Slide:

- Showed bookings growth: 10K → 100K → 1M

- Geographic expansion: 1 city → 10 cities → 50 cities

- Revenue growth chart with clear upward trend

- Customer testimonials and press mentions

Common Mistakes:

- ❌ Vanity metrics - App downloads instead of active users

- ❌ No growth - Flat or declining numbers

- ❌ Vague claims - "Thousands of users" instead of exact numbers

- ❌ Cherry-picking - Only showing one good month

- ❌ No context - Numbers without explanation of what they mean

Traction Slide Template

HEADLINE: Strong Growth and Validation

[Growth chart showing key metric over time]

KEY METRICS:

• Metric 1: [Number] ([X]% MoM growth)

• Metric 2: [Number] ([X]% MoM growth)

• Metric 3: [Number]

CUSTOMER VALIDATION:

"[Testimonial quote]" - Customer Name, Company

PARTNERSHIPS:

[Logo row of key partners or customers]

Slide 6: Business Model

What to Include

Core Elements:

- Revenue streams - How you make money

- Pricing strategy - What customers pay and why

- Unit economics - Cost to acquire and serve customers

- Revenue model - Subscription, transaction, advertising, etc.

- Path to profitability - When you'll be cash flow positive

Best Practices:

- Be clear and specific - Exact pricing and revenue model

- Show unit economics - CAC, LTV, gross margins

- Demonstrate scalability - How revenue grows with customers

- Prove viability - Show path to profitability

- Include validation - Evidence customers will pay

Common Revenue Models:

SaaS Subscription:

Pricing Tiers:

• Starter: $29/month

• Professional: $99/month

• Enterprise: $499/month

Unit Economics:

• CAC: $150

• LTV: $1,200

• LTV:CAC Ratio: 8:1

• Gross Margin: 85%

Marketplace:

Revenue Model:

• Take rate: 15% of transaction value

• Subscription: $19/month for premium features

Unit Economics:

• Average transaction: $100

• Revenue per transaction: $15

• Transactions per user/year: 12

• Annual revenue per user: $180

Freemium:

Conversion Funnel:

• Free users: 100,000

• Conversion rate: 5%

• Paid users: 5,000

• ARPU: $120/year

• Annual revenue: $600,000

Real-World Example:

Slack's Business Model:

- Freemium model with clear upgrade path

- Pricing: Free, $6.67/user/month, $12.50/user/month

- Showed conversion rate from free to paid

- Demonstrated negative churn (expansion revenue)

- Clear path to profitability with scale

Common Mistakes:

- ❌ Unclear monetization - "We'll figure it out later"

- ❌ Too complex - Multiple revenue streams that confuse

- ❌ No unit economics - Missing CAC and LTV calculations

- ❌ Unrealistic pricing - Prices customers won't pay

- ❌ No validation - No evidence of willingness to pay

Business Model Slide Template

HEADLINE: Proven Revenue Model

PRICING:

[Pricing tiers or transaction model]

UNIT ECONOMICS:

• CAC: $XXX

• LTV: $X,XXX

• LTV:CAC: X:1

• Gross Margin: XX%

REVENUE PROJECTION:

[Simple chart showing revenue growth]

PATH TO PROFITABILITY:

[Timeline or milestone]

Slide 7: Competition

What to Include

Core Elements:

- Competitive landscape - Direct and indirect competitors

- Differentiation - Your unique advantages

- Competitive positioning - Where you fit in the market

- Barriers to entry - What protects your position

- Competitive moats - Sustainable advantages

Best Practices:

- Acknowledge competition - Saying "no competitors" is a red flag

- Show differentiation - Clear advantages over alternatives

- Use visual frameworks - 2×2 matrices or comparison tables

- Be honest - Don't dismiss strong competitors

- Focus on your strengths - Highlight where you win

Competitive Analysis Frameworks:

2×2 Positioning Matrix:

High Price

|

Simple ----+---- Complex

|

Low Price

[Place competitors and your company on the matrix]

Feature Comparison Table:

Feature | You | Competitor A | Competitor B

-----------------+-----+--------------+-------------

Feature 1 | ✓ | ✓ | ✗

Feature 2 | ✓ | ✗ | ✓

Your Unique | ✓ | ✗ | ✗

Real-World Example:

Uber's Competition Slide:

- Positioned against taxis and car services

- Highlighted advantages: price, convenience, technology

- Showed market was large enough for multiple players

- Emphasized network effects as competitive moat

Common Mistakes:

- ❌ No competitors - Claiming no competition exists

- ❌ Dismissive - Underestimating strong competitors

- ❌ Too many competitors - Listing 20+ companies

- ❌ Unclear differentiation - Not explaining your advantages

- ❌ Feature parity - Showing you're the same as competitors

Competition Slide Template

HEADLINE: Clear Competitive Advantage

[2×2 matrix or comparison table]

OUR DIFFERENTIATION:

• Advantage 1

• Advantage 2

• Advantage 3

COMPETITIVE MOATS:

• Network effects / Technology / Brand / etc.

Slide 8: Team

What to Include

Core Elements:

- Founder backgrounds - Relevant experience and achievements

- Key team members - Critical roles and expertise

- Advisory board - Industry experts and mentors

- Why this team - What makes you uniquely qualified

- Hiring plans - Key positions to fill with funding

Best Practices:

- Highlight relevant experience - Domain expertise and track record

- Show complementary skills - Technical, business, and industry

- Include achievements - Previous exits, patents, awards

- Demonstrate commitment - Full-time dedication

- Add credibility - Notable advisors or investors

What Investors Look For:

- Domain expertise - Deep understanding of the problem and market

- Technical capability - Ability to build the product

- Business acumen - Understanding of go-to-market and scaling

- Track record - Previous successes and relevant experience

- Team chemistry - Evidence of strong working relationship

Real-World Example:

Airbnb's Team Slide:

- Brian Chesky: Design background from RISD

- Joe Gebbia: Design background, previous startup

- Nathan Blecharczyk: Technical expertise, previous CTO

- Emphasized design + technology combination

- Showed they lived the problem (renting their apartment)

Common Mistakes:

- ❌ Irrelevant experience - Backgrounds unrelated to the business

- ❌ Missing key roles - No technical co-founder for tech startup

- ❌ Too many people - Listing 15 team members

- ❌ No achievements - Generic job titles without accomplishments

- ❌ Solo founder - No co-founders or key team members

Team Slide Template

HEADLINE: Experienced Team with Domain Expertise

[Photos and names of founders]

FOUNDER 1 - CEO

• Previous: [Relevant experience]

• Achievement: [Notable accomplishment]

FOUNDER 2 - CTO

• Previous: [Relevant experience]

• Achievement: [Notable accomplishment]

ADVISORS:

[Names and credentials of key advisors]

KEY HIRES WITH FUNDING:

• VP Engineering

• Head of Sales

• Head of Marketing

Slide 9: Financials

What to Include

Core Elements:

- Revenue projections - 3-5 year forecast

- Key assumptions - Drivers behind your projections

- Path to profitability - When you'll be cash flow positive

- Key metrics - Growth rates, margins, unit economics

- Use of funds - How you'll spend the investment

Best Practices:

- Be realistic - Conservative projections are more credible

- Show your math - Explain assumptions and calculations

- Include scenarios - Best case, expected, worst case

- Focus on key metrics - Revenue, gross margin, burn rate

- Demonstrate capital efficiency - How far each dollar goes

Financial Projection Framework:

Year 1-3 Projections:

Year 1 Year 2 Year 3

Revenue $500K $2M $8M

Gross Margin 70% 75% 80%

Operating Exp $1.5M $3M $6M

Net Income -$1M -$1M $2M

Customers 100 500 2,000

ARPU $5,000 $4,000 $4,000

Key Assumptions:

- Customer acquisition: 10 → 50 → 150 per month

- Conversion rate: 5% → 7% → 10%

- Churn rate: 5% → 3% → 2%

- Average deal size: $5,000 → $4,000 → $4,000

Real-World Example:

Uber's Financial Slide:

- Showed revenue growth from $0 to $100M projection

- Included key metrics: rides, cities, drivers

- Demonstrated improving unit economics over time

- Clear path to profitability with scale

- Conservative assumptions with upside potential

Common Mistakes:

- ❌ Hockey stick projections - Unrealistic exponential growth

- ❌ No assumptions - Numbers without explanation

- ❌ Too detailed - Monthly projections for 5 years

- ❌ Ignoring costs - Only showing revenue, not expenses

- ❌ No path to profitability - Perpetual losses

Financials Slide Template

HEADLINE: Strong Growth with Path to Profitability

[Revenue growth chart]

PROJECTIONS:

Year 1 Year 2 Year 3

Revenue $XXX $XXX $XXX

Customers XXX XXX XXX

Margin XX% XX% XX%

KEY ASSUMPTIONS:

• Assumption 1

• Assumption 2

• Assumption 3

PROFITABILITY: [Quarter/Year]

Slide 10: The Ask

What to Include

Core Elements:

- Investment amount - How much you're raising

- Use of funds - Detailed breakdown of spending

- Milestones - What you'll achieve with this funding

- Timeline - How long the funding will last (runway)

- Next round - What comes after this raise

Best Practices:

- Be specific - Exact amount, not a range

- Show allocation - Pie chart or breakdown of spending

- Tie to milestones - Connect spending to achievements

- Demonstrate runway - 18-24 months is ideal

- Show ROI - How this investment creates value

Use of Funds Breakdown:

Typical Allocation:

Engineering & Product: 40%

• 3 engineers @ $150K = $450K

• Product manager @ $120K = $120K

• Infrastructure & tools = $30K

Sales & Marketing: 35%

• 2 sales reps @ $100K = $200K

• Marketing budget = $150K

• Sales tools & CRM = $50K

Operations: 15%

• Office & facilities = $50K

• Legal & accounting = $30K

• Insurance & admin = $20K

Buffer: 10%

• Contingency fund = $100K

Real-World Example:

Airbnb's Ask Slide:

- Raising: $600K seed round

- Use: Product development (40%), Marketing (35%), Operations (25%)

- Milestones: Launch in 10 cities, 10K bookings, $1M GMV

- Runway: 18 months to Series A

- Next round: $5M Series A at $1M GMV

Common Mistakes:

- ❌ Vague amount - "Raising $500K-$2M"

- ❌ No breakdown - Just the total without allocation

- ❌ Unrealistic runway - 6 months or 5 years

- ❌ No milestones - Not explaining what you'll achieve

- ❌ Wrong stage - Asking for Series A when you need seed

Ask Slide Template

HEADLINE: Raising $X Million

USE OF FUNDS:

[Pie chart showing allocation]

• Engineering: XX% - [Specific hires/projects]

• Sales & Marketing: XX% - [Specific activities]

• Operations: XX% - [Specific needs]

MILESTONES:

✓ Milestone 1 - [Timeline]

✓ Milestone 2 - [Timeline]

✓ Milestone 3 - [Timeline]

RUNWAY: 18-24 months to [Next milestone]

Design and Presentation Best Practices

Visual Design Principles

Design Fundamentals:

- Consistent branding - Use your brand colors, fonts, and logo

- Clean layout - Plenty of white space, not cluttered

- High-quality images - Professional photos, not stock clichés

- Readable fonts - Minimum 24pt for body text, 36pt+ for headlines

- Limited colors - 2-3 brand colors plus black and white

Typography Guidelines:

- Headlines: 36-48pt, bold, brand font

- Body text: 24-30pt, regular weight, readable font

- Captions: 18-20pt, lighter weight

- Avoid: Script fonts, all caps, excessive bold

Color Psychology:

- Blue: Trust, stability, professionalism (finance, healthcare)

- Green: Growth, sustainability, health (environment, wellness)

- Red: Energy, urgency, passion (consumer, entertainment)

- Purple: Innovation, creativity, luxury (tech, premium)

- Orange: Friendly, accessible, energetic (consumer, social)

Slide Layout Best Practices

The 1-6-6 Rule:

- 1 main idea per slide

- 6 lines of text maximum

- 6 words per line maximum

Visual Hierarchy:

- Headline - Largest, most prominent

- Key visual - Image, chart, or diagram

- Supporting text - Brief explanation

- Details - Minimal additional information

Common Layout Patterns:

Text + Image:

[Headline]

[Text on left 40%] [Image on right 60%]

Full-Screen Visual:

[Large background image]

[Headline overlay]

[Minimal text]

Data Visualization:

[Headline]

[Large chart or graph]

[Key takeaway]

Presentation Tips

Before the Pitch:

- Practice extensively - 20+ run-throughs minimum

- Time yourself - Stay within allocated time (usually 10-15 minutes)

- Anticipate questions - Prepare for common investor questions

- Test technology - Ensure slides work on presentation system

- Bring backup - PDF version on USB drive

During the Pitch:

- Tell a story - Connect slides into coherent narrative

- Make eye contact - Look at investors, not slides

- Show enthusiasm - Demonstrate passion for your mission

- Speak clearly - Pace yourself, don't rush

- Handle questions - Answer directly, admit when you don't know

After the Pitch:

- Send follow-up - Email deck and additional materials within 24 hours

- Answer questions - Respond promptly to investor inquiries

- Provide updates - Keep investors informed of progress

- Ask for feedback - Learn from every pitch

- Track interactions - Maintain CRM of investor conversations

Common Pitch Deck Mistakes to Avoid

Content Mistakes

1. Too Much Text

- Problem: Slides filled with paragraphs of text

- Impact: Investors can't read and listen simultaneously

- Solution: Use bullet points, keep text minimal

- Rule: If you can say it, don't write it

2. Unclear Value Proposition

- Problem: Investors don't understand what you do

- Impact: Lost interest in first 2 minutes

- Solution: Clear, simple explanation in first 3 slides

- Test: Can a 10-year-old understand your pitch?

3. Missing the "Why Now"

- Problem: No explanation of market timing

- Impact: Investors question urgency and opportunity

- Solution: Explain market trends and catalysts

- Examples: Technology advancement, regulatory change, behavior shift

4. Weak Traction

- Problem: No evidence of product-market fit

- Impact: Investors see high risk, low validation

- Solution: Show growth metrics, customer testimonials

- Alternatives: If pre-revenue, show user engagement, waitlist, LOIs

5. Unrealistic Financials

- Problem: Hockey stick projections with no basis

- Impact: Lost credibility and trust

- Solution: Conservative projections with clear assumptions

- Benchmark: Compare to similar companies' actual growth

Design Mistakes

6. Inconsistent Branding

- Problem: Different fonts, colors, styles across slides

- Impact: Looks unprofessional and rushed

- Solution: Create template with consistent styling

- Tools: Use Pitch, Canva, or PowerPoint templates

7. Poor Image Quality

- Problem: Pixelated, stretched, or low-resolution images

- Impact: Appears cheap and unprofessional

- Solution: Use high-quality images (Unsplash, Pexels)

- Minimum: 1920×1080 resolution for all images

8. Cluttered Slides

- Problem: Too much information on single slide

- Impact: Overwhelming and hard to follow

- Solution: Break into multiple slides, use white space

- Rule: One main idea per slide

Presentation Mistakes

9. Reading from Slides

- Problem: Presenter reads text verbatim

- Impact: Boring, disengaging, wastes time

- Solution: Slides are visual aids, not script

- Practice: Know your content, speak naturally

10. Going Over Time

- Problem: Pitch runs 25 minutes instead of 15

- Impact: Annoys investors, shows lack of preparation

- Solution: Practice timing, have shorter version ready

- Buffer: Aim for 80% of allocated time

11. Defensive Responses

- Problem: Getting defensive about questions or criticism

- Impact: Red flag about founder coachability

- Solution: Listen, acknowledge, respond thoughtfully

- Mindset: Questions are opportunities, not attacks

Industry-Specific Pitch Deck Variations

SaaS Pitch Decks

Key Differences:

- Emphasize recurring revenue - MRR/ARR growth

- Show unit economics - CAC, LTV, payback period

- Demonstrate scalability - Gross margins and efficiency

- Highlight retention - Churn rate and net revenue retention

- Include product demo - Show the actual software

Critical Metrics:

- Monthly Recurring Revenue (MRR)

- Customer Acquisition Cost (CAC)

- Lifetime Value (LTV)

- LTV:CAC ratio (target: 3:1 or higher)

- Churn rate (target: <5% monthly)

- Net Revenue Retention (target: >100%)

Consumer App Pitch Decks

Key Differences:

- Focus on engagement - DAU/MAU, time spent, sessions

- Show viral growth - Viral coefficient, organic growth

- Demonstrate retention - Day 1, 7, 30 retention curves

- Explain monetization - Path from users to revenue

- Include user testimonials - Social proof and reviews

Critical Metrics:

- Monthly Active Users (MAU)

- Daily Active Users (DAU)

- DAU/MAU ratio (target: >20%)

- Retention curves

- Viral coefficient

- Cost per install (CPI)

Marketplace Pitch Decks

Key Differences:

- Show both sides - Supply and demand growth

- Demonstrate liquidity - Transaction volume and frequency

- Explain chicken-and-egg - How you solved cold start

- Highlight network effects - Why it gets stronger with scale

- Show take rate - Revenue as % of GMV

Critical Metrics:

- Gross Merchandise Value (GMV)

- Take rate (revenue / GMV)

- Number of buyers and sellers

- Transactions per user

- Repeat purchase rate

- Marketplace liquidity

Hardware Pitch Decks

Key Differences:

- Show working prototype - Photos and videos of product

- Explain manufacturing - Supply chain and production plan

- Address capital intensity - Higher funding needs

- Demonstrate IP protection - Patents and defensibility

- Include unit economics - BOM cost, margins, pricing

Critical Metrics:

- Bill of Materials (BOM) cost

- Gross margin (target: >50%)

- Manufacturing capacity

- Pre-orders or LOIs

- Distribution partnerships

- Patent portfolio

Pitch Deck Templates and Resources

Free Pitch Deck Templates

Recommended Templates:

1. Y Combinator Template

- Format: Google Slides

- Slides: 10 core slides

- Best for: Early-stage startups

- Download: YC Startup Library

2. Sequoia Capital Template

- Format: PowerPoint

- Slides: 10-15 slides with detailed guidance

- Best for: Series A and beyond

- Download: Sequoia Resources

3. Pitch Template

- Format: Pitch.com (online tool)

- Slides: Customizable templates

- Best for: Design-focused startups

- Features: Collaboration, analytics, beautiful design

4. Canva Pitch Deck Templates

- Format: Canva (online tool)

- Slides: 100+ templates

- Best for: Non-designers

- Features: Drag-and-drop, stock images, easy customization

Pitch Deck Examples to Study

Successful Pitch Decks:

Airbnb (2009)

- Raised: $600K seed round

- Strengths: Clear problem/solution, simple design, strong traction

- Lesson: Simplicity and clarity win

Uber (2008)

- Raised: $200K seed round

- Strengths: Massive market opportunity, clear differentiation

- Lesson: Show the big vision

LinkedIn (2004)

- Raised: $4.7M Series A

- Strengths: Network effects, clear business model

- Lesson: Demonstrate defensibility

Buffer (2011)

- Raised: $500K seed round

- Strengths: Transparent metrics, clear traction

- Lesson: Show real numbers

Front (2014)

- Raised: $10M Series A

- Strengths: Product demo, customer testimonials

- Lesson: Let customers tell your story

Tools and Resources

Presentation Tools:

- Pitch - Modern presentation software with collaboration

- Canva - Easy design tool with templates

- Google Slides - Free, collaborative, accessible

- PowerPoint - Traditional, powerful, widely compatible

- Keynote - Beautiful designs, Mac-only

Design Resources:

- Unsplash - Free high-quality stock photos

- Pexels - Free stock photos and videos

- Flaticon - Free icons and illustrations

- Coolors - Color palette generator

- Font Pair - Font combination suggestions

Data Visualization:

- Datawrapper - Easy chart creation

- Flourish - Interactive data visualizations

- Infogram - Infographics and charts

- Google Charts - Free charting library

Preparing for Investor Questions

Common Investor Questions

About the Market:

-

"How big is the market really?"

- Be ready to defend your TAM/SAM/SOM calculations

- Show bottom-up analysis, not just top-down

- Explain market growth drivers

-

"Who are your competitors?"

- Acknowledge all competitors, direct and indirect

- Explain your differentiation clearly

- Show why customers choose you

-

"Why now? What's changed?"

- Identify market catalysts and trends

- Explain technology or behavior shifts

- Show why timing is right

About the Product:

-

"What's your unfair advantage?"

- Explain your competitive moats

- Highlight technology, network effects, or brand

- Show what's defensible long-term

-

"How does the product work?"

- Be ready for technical deep-dive

- Explain architecture and key innovations

- Show actual product, not just mockups

-

"What's your product roadmap?"

- Share 6-12 month development plan

- Explain prioritization and rationale

- Show how it ties to customer needs

About Traction:

-

"What are your unit economics?"

- Know CAC, LTV, payback period cold

- Show how they improve with scale

- Explain path to profitability

-

"What's your churn rate?"

- Be honest about retention

- Explain what you're doing to improve it

- Show cohort analysis if available

-

"How do you acquire customers?"

- Explain your go-to-market strategy

- Show which channels work best

- Demonstrate scalability of acquisition

About the Team:

-

"Why are you the right team?"

- Highlight relevant experience and expertise

- Show complementary skills

- Demonstrate commitment and passion

-

"What are your biggest risks?"

- Be honest about challenges

- Show you've thought through mitigation

- Demonstrate self-awareness

-

"What happens if [competitor] does this?"

- Show you understand competitive dynamics

- Explain your defensibility

- Demonstrate strategic thinking

About the Raise:

-

"Why this amount?"

- Tie to specific milestones

- Show detailed use of funds

- Explain runway and next round

-

"What's your valuation?"

- Have a number and rationale ready

- Show comparable companies

- Be willing to negotiate

-

"What if you don't raise this round?"

- Show you have alternatives

- Explain path to profitability or next milestone

- Demonstrate you're not desperate

How to Handle Tough Questions

The Framework:

- Listen fully - Don't interrupt, understand the question

- Pause briefly - Take a moment to think

- Acknowledge - Show you heard and understand

- Answer directly - Be honest and specific

- Provide context - Explain reasoning and data

Example Responses:

Question: "Your churn rate seems high at 8% monthly."

Bad Response: "That's actually pretty normal for our industry."

Good Response: "You're right, 8% is higher than we'd like. We've identified that churn happens primarily in the first 30 days due to onboarding issues. We've implemented a new onboarding flow that's reduced churn to 5% for the last two cohorts, and we're targeting 3% by end of quarter."

When You Don't Know:

- Be honest: "That's a great question. I don't have that data with me, but I'll get it to you by tomorrow."

- Show process: "We haven't analyzed that specifically yet, but here's how we'd approach it..."

- Commit to follow-up: "Let me research that and send you a detailed answer."

Next Steps After Creating Your Deck

Testing Your Pitch Deck

Internal Review:

- Team review - Get feedback from co-founders and team

- Advisor review - Share with mentors and advisors

- Friendly investor review - Practice with investors who know you

- Customer review - Ensure value prop resonates

- Industry expert review - Validate market and competitive analysis

Key Questions to Ask:

- Is the problem clear and compelling?

- Is the solution easy to understand?

- Are the market size calculations credible?

- Is the traction impressive and growing?

- Is the team qualified and complete?

- Is the ask clear and justified?

Iterating Based on Feedback

Common Feedback Themes:

- "I don't understand what you do" → Simplify solution slide

- "The market seems small" → Expand market analysis

- "Where's the traction?" → Add more metrics and validation

- "Why you?" → Strengthen team slide

- "This seems expensive" → Justify use of funds better

Iteration Process:

- Collect feedback - From multiple sources

- Identify patterns - What do multiple people say?

- Prioritize changes - Fix biggest issues first

- Update deck - Make targeted improvements

- Re-test - Get feedback on new version

- Repeat - Continue until consistently positive

Building Your Investor Pipeline

Research Phase:

- Identify target investors - Match stage, sector, geography

- Study their portfolio - Understand investment thesis

- Find connections - Leverage network for warm intros

- Prioritize outreach - Start with best-fit investors

- Prepare materials - Deck, executive summary, data room

Outreach Strategy:

- Warm introductions - Always better than cold emails

- Personalized messages - Reference their portfolio and thesis

- Clear ask - Request specific meeting or call

- Follow-up cadence - Persistent but not annoying

- Track interactions - Use CRM to manage pipeline

Conclusion: Your Path to a Winning Pitch Deck

Creating a compelling pitch deck is both an art and a science. It requires clear thinking about your business, honest assessment of your progress, and the ability to tell a compelling story that inspires investor confidence.

Key Takeaways:

✓ Start with the story - Connect slides into coherent narrative ✓ Show, don't tell - Use visuals, data, and evidence ✓ Be honest and realistic - Credibility is everything ✓ Practice extensively - Great pitches come from preparation ✓ Iterate based on feedback - Your deck will improve with each version

Your Action Plan:

- Download a template - Start with proven structure

- Draft your slides - Get content down first, design later

- Get feedback - Share with advisors and friendly investors

- Refine and polish - Improve based on feedback

- Practice your pitch - Rehearse until it's natural

- Start pitching - Learn and improve with each presentation

Remember, your pitch deck is a living document. It will evolve as your business grows, your traction improves, and you learn what resonates with investors. The best pitch decks are clear, compelling, and backed by real evidence of progress.

Ready to raise funding? Check out our comprehensive Startup Funding Guide for everything you need to know about the fundraising process, from preparation to closing.

Need help with your launch strategy? Our Bootstrap Startup Guide shows you how to build and grow without external funding.

Good luck with your fundraising journey!

Have questions about your pitch deck? Join the conversation on OpenHunts and connect with founders who've successfully raised funding.